5 Simple Techniques For Bank Certificate

9 Easy Facts About Bank Reconciliation Shown

Table of ContentsNot known Facts About Bank Account NumberSome Known Factual Statements About Bank Code 9 Easy Facts About Bank Reconciliation DescribedThe Definitive Guide for Bank Definition

You can additionally conserve your cash and earn passion on your financial investment. The money stored in many savings account is federally insured by the Federal Down Payment Insurance Corporation (FDIC), up to a limitation of $250,000 for private depositors as well as $500,000 for collectively held deposits. Banks additionally provide debt possibilities for people as well as companies.

Banks make a profit by charging more interest to customers than they pay on savings accounts. A financial institution's dimension is figured out by where it lies as well as who it servesfrom small, community-based organizations to big business banks. According to the FDIC, there were just over 4,200 FDIC-insured business financial institutions in the USA as of 2021.

Standard banks provide both a brick-and-mortar area and also an on the internet presence, a brand-new trend in online-only banks arised in the very early 2010s. These banks frequently use customers higher rate of interest as well as lower costs. Convenience, rate of interest, as well as costs are several of the aspects that help consumers choose their liked banks.

Some Known Details About Bank

The regulative environment for banks has given that tightened substantially as an outcome. U.S. banks are regulated at a state or national level. State banks are managed by a state's department of financial or division of economic establishments.

, for example, takes deposits as well as provides in your area, which can use a more tailored banking connection. Pick a convenient area if you are selecting a bank with a brick-and-mortar location.

Excitement About Bank Account Number

Some banks additionally use smartphone applications, which can be valuable. Some large financial institutions are moving to end over-limit costs in 2022, so that could be an important consideration.

Money & Development, March 2012, Vol (bank draft meaning). 49, No. 1 Organizations that pair up savers and also borrowers aid make certain that economic situations work smoothly YOU have actually obtained $1,000 you don't need for, say, a year and desire to earn income from the cash until then. Or you intend to buy a residence as well as need to borrow $100,000 as well as pay it back over 30 years.

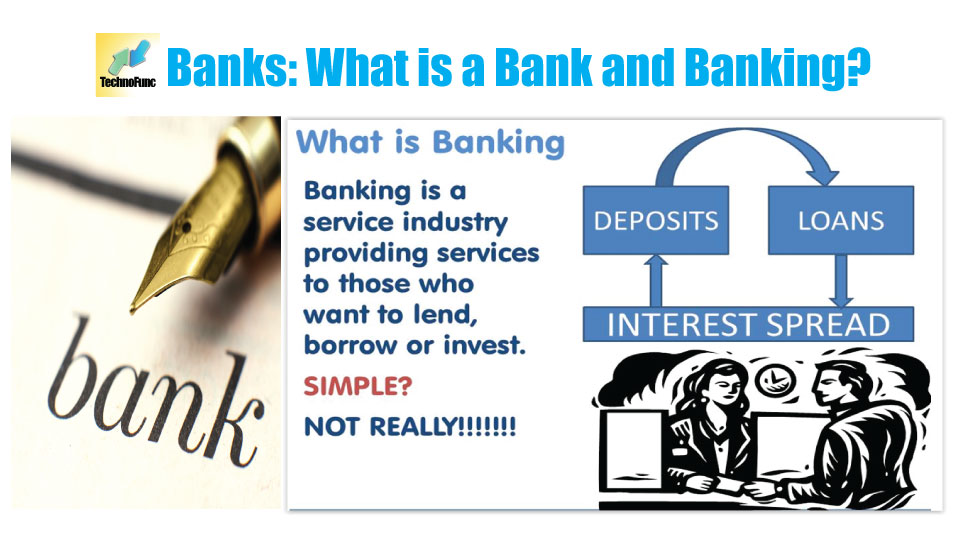

That's where banks come in. Although banks do many things, try this their main function is to absorb fundscalled depositsfrom those with cash, swimming pool them, and also lend them to those who require funds. Financial institutions are intermediaries between depositors (who lend cash to the financial institution) and also customers (to whom the bank offers money).

Down payments can be available on demand (a checking account, for example) or with some limitations (such as financial savings as well as time down payments). While at any provided moment some depositors require their cash, a lot of do not.

4 Simple Techniques For Bank Account Number

The procedure involves maturity transformationconverting temporary responsibilities (down payments) to long-term assets (finances). Banks pay depositors much less than they get from consumers, which difference accounts for the bulk of financial institutions' income in a lot of nations. Financial institutions can enhance typical down payments as a resource of funding by straight borrowing in the money and also resources markets.

Financial institutions maintain those needed books on deposit with reserve banks, such as the United State Federal Book, the Financial Institution of Japan, and also the European Reserve Bank. Financial institutions create money when they lend the remainder of the cash depositors provide. This cash can be made use of to acquire goods and services and can discover its method back right into the financial system as a down payment in an additional bank, which then can lend a fraction of it.

The size of the multiplierthe quantity of bank draft cash produced from a preliminary depositdepends on the quantity of cash financial institutions must continue get (bank). Banks additionally offer and also recycle excess cash within the economic system and create, distribute, and trade safeties. Financial institutions have a number of means of earning money besides swiping the difference (or spread) between the passion they pay on down payments as well as borrowed money as well as the rate of interest they gather from consumers or securities they hold.